West Bengal VAT Commercial TAX Registration. William Lawsons Blended scotch 750 ml.

Https Www Jstor Org Stable 29793957

Site Designed hosted and maintained by National Informatics Centre Best viewed in Internet Explorer 80 Firefox 36 or later.

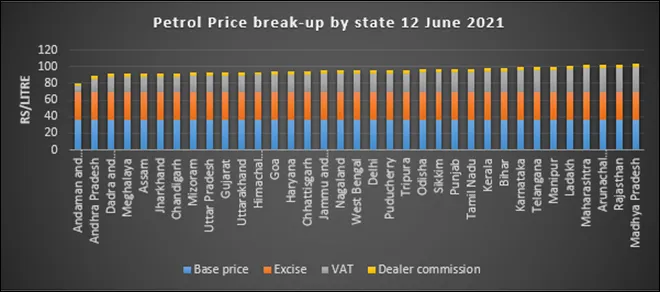

Vat rate in west bengal. Aids and implements 1A used by handicapped persons including. Rs 1297 Litre on Diesel Final Retail Price as on 5th July 2021 in Delhi. No tax is payable on the following goods under Schedule A while some goods are zero-rated under Schedule AA.

Fuel rate prior to Value-added Tax Rs5406 per litre Value-added Tax VAT Rs1312 per litre Commission charged to pump owners Rs357 per litre Retail selling price per litre Rs7075 per litre. Petrol Price in West Bengal The Petrol prices in West Bengal are based on dynamic fuel pricing system and hence revised on a regular basis. Also some goods are zero rated under schedule AA while many goods are taxable at 5 under schedule C.

The petrol rates are revised at 6 am every day. Rs 9986 per Litre. Rs 7681 per Litre.

AS ON 01042013 SCHEDULE A See section 21 Goods on sale of which no tax is payable Serial No. The rate varies from 145 to 35 There is Schedule AA also which specifies sales which shall be treated as Zero Rated ie. Tax payable on such sales is zero.

RETURN FILING AND PAYMENT OF VAT Under VAT return will be simple where the number of tax rates have been brought down to two principal rates namely 4 and 125. VAT 69 750. West Bengal VAT Commercial Tax Registration forms are available online.

WEST BENGAL VAT ACT and CST RULES PROCEDURAL ISSUES 1. Several goods are taxable at 5 under Schedule C. The price of Petrol in West bengal is at Rs 10193 per litre Today.

In view of the above the rate of reversal of input tax credit should have been reduced to 2 with effect from 01062008 in line with the reduction in rate of CST from that date. Additional Cess on Diesel 5th July 2021 Rs 2305 Litre on Petrol. In the interest of fairness to the tax payers the Chamber requests the following actions.

Building Construction materials rate in West Bengal. About West Bengal VAT Value Added Tax The West Bengal VAT Act 2003 has laid down the framework for regulations across the state. White Mischief 180 ml.

West Bengal VAT Rates. The West Bengal VAT Act 2003 has laid down the framework for regulations across the state. For example sales by a dealer to a dealer located in SEZ etc.

Member or members of the Defence Forces of India within West Bengal were declared to be. Reversal of Input Tax Credit on inter-State Stock Transfers As per existing provisions of VAT laws input tax credit up to 3 previously it was 4 is denied to dealers in the event the taxable goods are sent out of the State otherwise than by way of sale ie by way of inter-State stock. Fuel Cost Before VAT Cost as on 5th July 2021.

Rs 7629 per Litre VAT Calculation AdditionalVAT 30 on Petrol and 1675 on Diesel. Contents provided by the Excise Directorate Government of West Bengal. Therefore no tax will be payable on the following goods under schedule A.

Rs 8936 per Litre. SALES NOT TAXABLE UNDER THE. White Mischief 375 ml.

Please note that Construction materials are classified based on the item type and construction State Prices may vary between Whole Sale Dealer Online Retailer transport cost GST etc. 1800 121 0060 Toll Free 9836529667 9830633755 9163138658 9239244758 7122-1000 1222 7122-1527 Tax evasion is a crime. Government of West Bengal Help Desk.

The rate of deduction of STDS and TCS are as follows- i. Agricultural implements manually operated or animal driven. The said reduction is yet to be implemented in West Bengal VAT Act.

SCHEDULES UNDER THE WEST BENGAL VALUE ADDED TAX ACT 2003. White Mischief lemon 180 ml. 3 percent where the dealer is registered under the West Bengal VAT Act 2003 and produces e-certificate of filing return obtained from the Commercial Tax website.

Goods not specified in Schedule A Schedule B and Schedule C are taxable at 145. As on June 2017 Petrol. Items such as Tobacco pan masala television mobile phone are taxable at a rate not above 35 of turnover under Schedule D.

No tax is payable on the following goods under Schedule A. White Mischief 750 ml. White Mischief Orange 750 ml.

Conditi ons and Excepti ons 1 2 3 1.

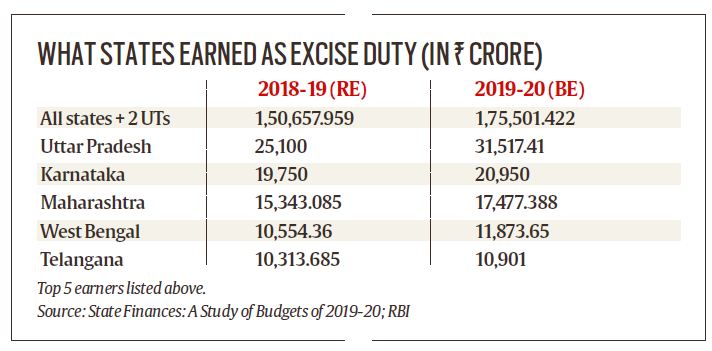

Fuel Taxes Most And The Least Earning States In The Country

Fuel Taxes Most And The Least Earning States In The Country

States Wary Of Gst On Petroleum Business Standard News

Who Takes What Share Of Petrol And Diesel Prices In India Orf

Who Takes What Share Of Petrol And Diesel Prices In India Orf

West Bengal Tops Gst Enrolment Chart At 89 3 So Far Business Standard News

The Great Indian Fuel Tax Trick How Government Is Now Eyeing A 21 Billion Windfall The New Indian Express

The Great Indian Fuel Tax Trick How Government Is Now Eyeing A 21 Billion Windfall The New Indian Express

Vat And Excise Rates In West Bengal

Vat And Excise Rates In West Bengal

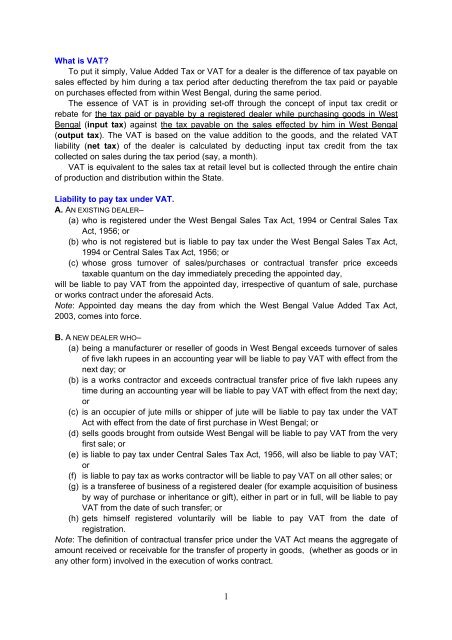

What Is Vat To Put It Simply Value Added Tax Or Vat For A Dealer

What Is Vat To Put It Simply Value Added Tax Or Vat For A Dealer

Http Www Mids Ac In Assets Doc Wp 164 Pdf

West Bengal Slashes Petrol Diesel Prices Cuts Vat By 1 Rupee Per Litre Latest News India Hindustan Times

West Bengal Slashes Petrol Diesel Prices Cuts Vat By 1 Rupee Per Litre Latest News India Hindustan Times

West Bengal Dues From Centre More Than Rs 50 000 Crore Amit Mitra Business Standard News

West Bengal Dues From Centre More Than Rs 50 000 Crore Amit Mitra Business Standard News

Liquor Associations Warn Against Proposed Tax Hikes In West Bengal Business Standard News

Liquor Associations Warn Against Proposed Tax Hikes In West Bengal Business Standard News

West Bengal Govt Reduces State Tax On Petrol Diesel By Rs 1 Per Litre India News

West Bengal Govt Reduces State Tax On Petrol Diesel By Rs 1 Per Litre India News

How States Earn From Liquor Sales

How States Earn From Liquor Sales

Http Wbcomtax Nic In Circulars 24x Pro Vat 15 269 27 01 2016 Century 20agencies Pdf

Https Journals Sagepub Com Doi Pdf 10 1177 2277978716671066

0 Response to "Vat Rate In West Bengal"

Posting Komentar