Single e-way bill generation and bulk e-way bill generation. Dated 30062017 a brand-new electronic system is going to be introduced on and from the 1st July 2017 in regard of issuance of Way Bills under the West Bengal Goods and Services Tax Ordinance 2017.

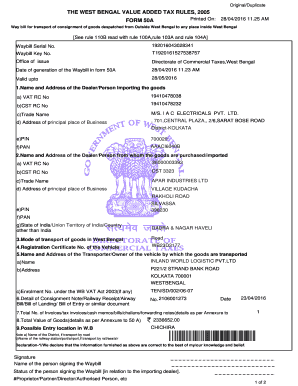

Fillable Online Egov Wbcomtax Gov 25 Am Way Bill For Transport Of Consignment Of Goods Despatched From Outside West Bengal To Any Place Inside West Bengal See Rule 110b Read With Rule

Fillable Online Egov Wbcomtax Gov 25 Am Way Bill For Transport Of Consignment Of Goods Despatched From Outside West Bengal To Any Place Inside West Bengal See Rule 110b Read With Rule

The West Bengal government on Thursday increased up to Rs 1 lakh the threshold limit for the electronic-way or e-way bill in case of movement of goods.

West bengal waybill rules. For more details on e-waybill including procedures of detention seizure etc. The West Bengal VAT rules provide for adjustment of excess tax in a subsequent return only if the subsequent return falls within the financial year. Government of West Bengal- Directorate of Commercial Taxes 0.

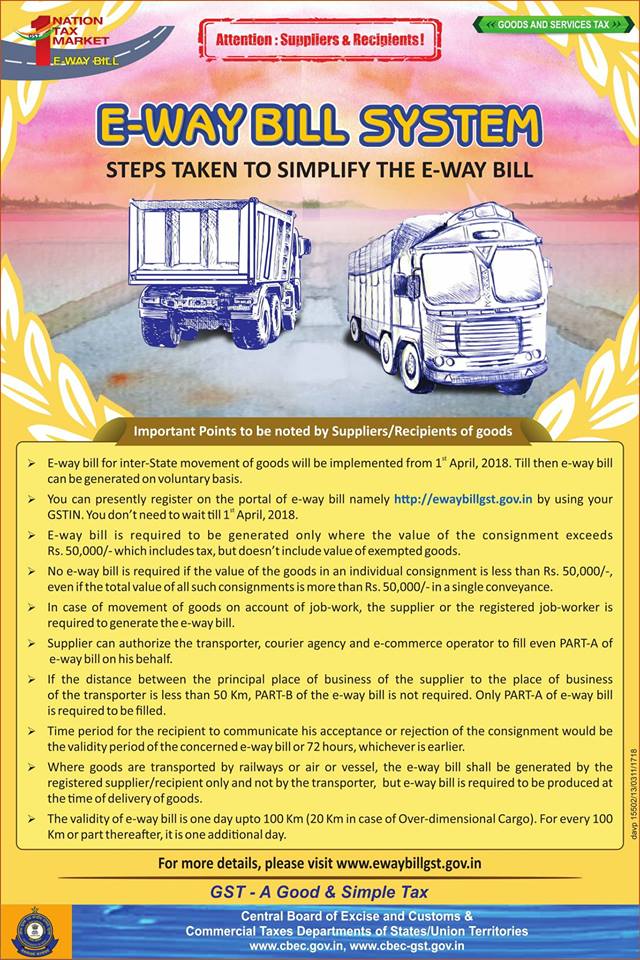

The new e-way bill system is expected to face a few challenges. The same job was the Maharashtra government has done before. The process of generation of e-way bill are as under.

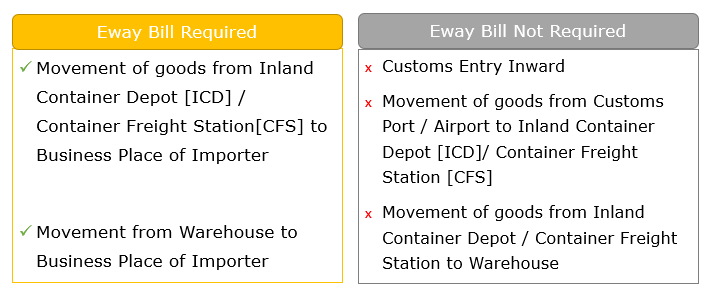

41 E-way bill for the invoices for which IRN obtained can be generated from the e-invoice portal. 072018-CTGST dated 29032018 and No. 112018-CTGST dated 30052018 have been issued by the Commissioner notifying that no e-waybill shall be required to be generated where the movement of goods commences and terminates within the State of West Bengal intra-State till 31st day of May 2018 and that the provisions of rule.

In regards to Finance Department Notification No. Complete information is provided here. E-Waybill_FAQ_dated_24032018 To notify that irrespective of the value of the consignment no way bill under rule 138 shall be required to be generated in case of intra-State movement of goods Help Desk for e-Waybill.

Also the West Bengal government has published a notification regarding e way bill threshold limit and job work. The unique number generated is valid for a period of 15 days as per the requirement of e way bill rules. In this video you will learn about e - way bill in gst.

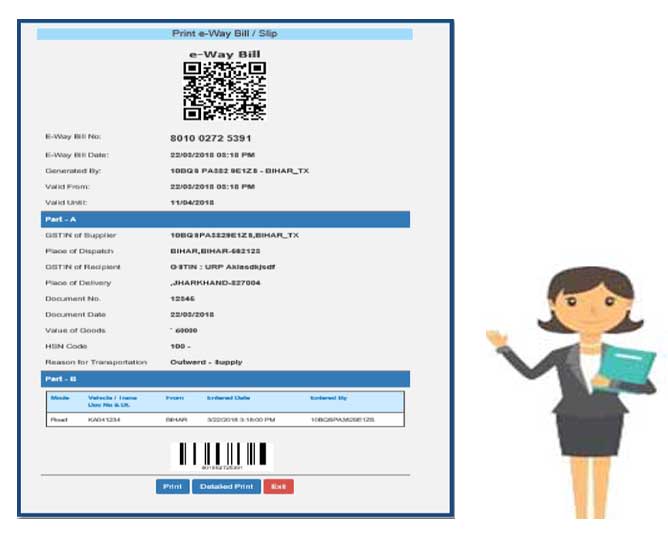

Whereas notifications under clause d of sub-rule 14 of rule 138 of the West Bengal Goods and Services Tax Rules 2017 bearing No. How To Generate E-way bill using IRN. The e-Way bill generated shall have a limited validity during.

Also the Punjab government has increased the threshold limit of E Way Bill from 50000 to 1 lacs along with no e way bill required to job work. On the other hand as per the notification issued by the West Bengal state government the e-way bill for intra-state movement of goods was made mandatory from 3rd June 2018. E-waybill shall be required to be generated for intra-State movement of goods within the State of West Bengal for consignment value exceeding rupees 50000- fifty thousand rupees.

For further information please refer the attached document. The rules for the West Bengal e-way bill is prescribed in Rule 138 WBGST Rule 2017 notified in Notification No. General Steps for generation West Bengal GST e-way expense WBGST E-Way Bill.

Till 15022018 any consignment entering West Bengal without either existing waybill or new e-waybill shall be treated as punishable offence as per provisions of the WBGST Act 2017 and rules framed thereunder. If the e-Way bill has been verified by a Proper Officer during its transit it cannot be cancelled. Way bill in FORM GST EWB-01 electronically on the common portal after furnishing information in Part B of FORM GST EWB-01.

3 Where the e-way bill is not generated under sub-rule 2 and the goods are handed over to a transporter for transportation by road the registered person shall. Httpseinvoice1gstgovin 42 There are two way of generation of e-way bill ie. Now in exercise of the powers conferred by clause d of sub-rule 14 of rule 138 of the West Bengal Goods and Services Tax Rules 2017 and after consultation with the Principal Chief Commissioner of Central Tax Kolkata Zone it is hereby notified that the e-waybill in respect of movement of goods originating and terminating within the State of West Bengal intra-State.

This restriction causes needless hardship in case where the next return is due in the next financial year. E way bill validity period. Cancellation of unused waybill keys shall continue till 15042018 after which allremaining unused keys will be cancelled by system.

Eway bill is required to be generated where the consignment value exceeds Rs. Dated 7th March 2018 and shall be referred at the below link. Rule 138 of the WBGST Rules 2017 provides for the e-way bill mechanism and in this context it is important to note that information is to be furnished prior to the commencement of movement of goods and is to be issued whether the movement.

However PART-B can be updated any number of times within the overall e-way bill validity period. You will know about all the form of way bill and who will gene. E-way bill challenges.

Businesses in West Bengal who send goods outside the state have to register themselves on a one-time basis at the e-way bill West Bengal portal and start generating e-way bills from 1st April 2018. Analysts report that because states have been given the power to implement their own e-way bill rules if states prepare different rules from each other than uniformity within the system the very purpose for which it was intended will be lost. Waybills generated till midnight of 31032018 shall be valid for entry of taxablegoods into West Bengal till 15042018 or till its validity expires whichever isearlier.

Gst E Way Bill Login System A Complete Guide For 2021

Gst E Way Bill Login System A Complete Guide For 2021

Eway Bill Rules And Requirements For Import Transactions Eway Bill

Eway Bill Rules And Requirements For Import Transactions Eway Bill

E Way Bill Rules For Job Work Youtube

E Way Bill Rules For Job Work Youtube

E Way Bill Extension After Expiry Allowed New Rule Notified Good News Youtube

E Way Bill Extension After Expiry Allowed New Rule Notified Good News Youtube

Gst E Way Bill Latest Notification For Interstate Intrastate Transactions

Gst E Way Bill Latest Notification For Interstate Intrastate Transactions

E Way Bill For Transport Of Goods Under Gst Taxmann Blog

E Way Bill For Transport Of Goods Under Gst Taxmann Blog

Learn And Understand E Way Bill Rules And Applicability Under Gst Knowyourgst Com

Learn And Understand E Way Bill Rules And Applicability Under Gst Knowyourgst Com

Fillable Online Egov Wbcomtax Gov 25 Am Way Bill For Transport Of Consignment Of Goods Despatched From Outside West Bengal To Any Place Inside West Bengal See Rule 110b Read With Rule

Fillable Online Egov Wbcomtax Gov 25 Am Way Bill For Transport Of Consignment Of Goods Despatched From Outside West Bengal To Any Place Inside West Bengal See Rule 110b Read With Rule

Tamil Nadu E Way Bill Limit Intra State Limit

Tamil Nadu E Way Bill Limit Intra State Limit

What Is Gst E Way Bill How To Generate Via Online Or Sms Sag Infotech

What Is Gst E Way Bill How To Generate Via Online Or Sms Sag Infotech

Important Amendment In E Way Bill W E F 01st January 2021

Important Amendment In E Way Bill W E F 01st January 2021

Gst E Way Bill Latest Notification For Interstate Intrastate Transactions

Gst E Way Bill Latest Notification For Interstate Intrastate Transactions

Odisha E Way Bill Limit Intra State Limit

Odisha E Way Bill Limit Intra State Limit

Gst Council Meet Today Anti Profiteering E Way Bill Provisions In Prime Focus The Financial Express

Gst Council Meet Today Anti Profiteering E Way Bill Provisions In Prime Focus The Financial Express

E Way Bill Extension After Expiry Allowed New Rule Notified Good News Youtube

E Way Bill Extension After Expiry Allowed New Rule Notified Good News Youtube

Updating Eway Bill And Cancellation Rules In India Legal Raasta

Updating Eway Bill And Cancellation Rules In India Legal Raasta

0 Response to "West Bengal Waybill Rules"

Posting Komentar